Banking in Denmark

Banking in Denmark is quite easy and opening an account is just a matter of having a CPR number and than you can get a Dankort and Nem Konto. More information below on those items.

Before you open a bank account in Denmark, it is important that you have obtained a CPR Number, which makes opening an account possible. It is sometimes possible to open an account without one, but it is not easy and you will not get full services. Nordea and Danske Bank have a reputation for being helpful in that regard, but banking has become much less personal over the years and finding a helpful account manager can be difficult.

Once you have an account open, you should find out that banking in Denmark just got much easier, because that will your biggest hurdle. Now you can transfer money from your home account immediately. Remember, even if you have a job, it can take weeks or months before the first paycheck is put into your account.

Also, if you only have a residence permit and not a work permit, you must prove that you are financially capable of supporting yourself. Having money in a Danish bank will help appease the government that you are self sufficient and not here to sponge off the system.

Once you have an account open, you can get a banking cash card, so that you can withdraw your funds from cash machines all over Denmark. It is usually free to withdraw money from a cash machine from your bank or one of its branches. If you use it from other bank teller machines, you will be charged. You should find about all the various fees from your bank. Banks charge for nearly everything related to customer service including meeting with a customer service person.

Shop around for a bank that has internet banking in Denmark (preferably in English or your native language). Also find out if you can get an account manager, who you can talk to in your native language especially about loans, contracts, insurance, etc.. It helps to be able to get your documents in your own language too. Banking terms can be tricky without having to learn them in another language.

A good place to compare fees and services is at www.mybanker.dk . They do not have an english version, but google translate works well with the site.

Dankort

The Dankort is the major banking in Denmark debit card. You will want to apply for a Dankort as soon as you can. Some banks may:

- make you wait several months

- want to see copy of your paychecks

- require a healthy bank balance

before issuing you a card. They may require any of the above or may just put you in for a card. It can take several weeks to get a card.

It is good to discuss the conditions for getting a Dankort before opening an account. Shop around for a bank who is accommodating in this regard, since a Dankort is the "national currency".

The Dankort is a debit card which can be used nearly everywhere in Denmark and is more used than credit cards or cash. When you are ready to buy something, just pop it in the reader and punch in your security code and the money is taken directly out of your bank account. You can even get cash back. When shopping the cashier will usually ask you something at the end of the transaction, which is " på beløbet?", which means " for the exact amount?

If you do not want cash back, answer "på beløbet". If you want cash back, say "jeg vil gerne have 100 kroner over" (I would like to have 100 kroner over the amount."). Of course you can ask for as much as you need, but rarely does anyone ask for more than 500 kroner.

If you use credit cards, which can also be obtained at your bank, you will be charged for the credit cards and also pay interest on the purchase financed.

The Dankort is usually given to you - free of charge. Today some banks do charge for it, yet there is no charge for using it. Hey, it is your money. If you don't have sufficient funds in your account, you can not use the card.

Nem Konto

When you set up your bank account, ask to have a Nem Konto set up at the same time. This is an account linked to your personal bank account, but it is also linked to your CPR number and the government uses it when sending you payments. Every resident in Denmark is required to have a Nem Konto.

Yes, the government does send you money for various reasons; tax refunds, child payments, prescriptions subsidies, pension, etc.

They use your CPR number for such payments and if you have your Nem Konto set up properly, the money gets sent directly to your bank account.

Just ask your bank to do it for you, when you open your banking in Denmark konto or you can do it online at www.nemkonto.dk , which has the information in Danish, English and German.

NemId

Your bank will sign you up for NemID, which is a digital signature, that allows you to access both public and private internet services such as your online banking, tax information, commune data, etc. using the same login information. You will have 2 parts to the login.

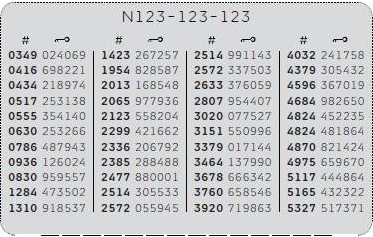

First you have your own your signin and password. This is usually your CPR number and a password you decide on. The second part comes as a code card. The code card has 148 keys on it. When you log on to a site that requires the NemId, you use your signin and password and than one of the codes from your code card will appear on the screen. This will be a 4 digit code. You look on the card and find that number (it is in sequential order, so easy to find) and there is 6 digit number next to it. You type in that 6 digit number and you will get access. The code number is in bold on your code card and the number you type in is in normal type. There is also a (#) in the column for the 4 digit code and a (key) above the 6 digit code that you enter. See the image for clarification. Remember you can use this system on any computer, but make sure it is safe and ALWAYS log off to prevent Fraud.

Banking in Denmark Hours

Banking in Denmark hours are unfortunately not very good and you will rarely have time to actually enter your bank if you work normal hours.

Banks are only open Monday to Friday. Hours are 10 am to 4 pm, except on Thursdays when most banks are open to 5 pm or 5:30 pm. These hours may vary a little bit especially in Copenhagen, but these are the normal banking in Denmark hours That is why it is nice to have internet banking. Phone hours can vary greatly, but they usually open at 8am for business. You can also email your bank with questions and they are pretty good about calling you back the same day. Banks are not open on weekends, but there are phone services for businesses or stolen cards.

Banking in Denmark Tips

- Find a good bank for your banking in Denmark.

- If you use foreign credit cards, you will be charged a surcharge and it is best to avoid using them in Denmark. Many places do not accept them and some do not even accept Danish credit cards.

- If you need foreign currency exchanged, your bank will usually waive the commission, but check with other banks for better exchange rates to be sure.

- When banking in Denmark, you can not just walk up to a teller. Most banks have a ticket machine and you must take a number. Even if there is no else in the bank. The ticket machines are located just inside the main lobby door. Once you get your ticket wait for the number to be lit up on the screen above the tellers counter. They will also call out the number (in Danish). Now you can approach the teller. Just toss the ticket in the bin at the counter. You don't need to show it to the teller. See image below.

- Banks sell lots of services like insurance and it is always good to compare their rates with other insurance companies. Always ask what things will cost - the total fee - before agreeing to buy anything from your bank. They have many hidden fees.

- It is also a good idea to set up automatic payments via a betalingsservice/ PBS. For those regular bills like rent, utilities, car payments, etc. you can get your bank to make the payments for you. Lots of companies will require you to this. Ask your bank for assistance. This can also be done via your online banking.

- Learn your IBAN and Swift bank codes so you can do international bank

transfers.

Internet Banking

It is always best to have internet banking or E-banking in Denmark When you get it set up, you can call customer support and have them walk you through how to pay bills, check your bank balance and transfer money online. You will also have access to all your bank statements, since banks do not send out paper statements unless you request them.

There is a payment system in Denmark called the giro, which is explained in more detail on the money page. You can use a direct debit payment service called betalingsservice (which means payment service), where your recurring bills (montly, quarterly) can be submitted and paid automatically. You can keep track of the bills and check to make sure they are correct, but the bills are automatically paid. You can stop a payment if there is a dispute.

Most banking services are now done online, so it is expedient to get use to using the internet for paying bills and all other banking in Denmark needs unless you wish to pay extra fees.

Continue getting started with other helpful adice.

|

|

|

If you found this page helpful, please give a google+ and or a facebook like at the top of the screen, so others can also find this information. Thank you.

Please feel free to comment on this subject

Do you have a helpful tip or comment on this subject that you would like to share? Please leave comments below.

What Other Visitors Have Said

Click below to see contributions from other visitors to this page...

Consultant Not rated yet

I did a short-term contract in Copenhagen of less than 6 months. I'm an EU citizen and I registered and got a CPR number. I didn't find that getting …

Opening a bank account in Denmark Not rated yet

I am planning on moving to Denmark in a few years. I would like to start putting money in a bank account there but I am not in a position to get a CPR …

Banking in Denmark for student Not rated yet

My son will be attending DIS college in Copenhagen for the fall semester. Can you advise me on the best way for him to set up his banking so he is not …

Banking Page Update Not rated yet

Dear Sir/Madam, The company which I work for, Kirby Group is conducting research on the Danish market. I discovered information regarding Danish banking …

Quality facemasks are in high demand and hard to find. We have found these quality masks here for only 14kr. Going fast so get yours today! Click Here.

Recent Articles

-

Home Furnishing Shops in Denmark

Feb 16, 24 11:10 AM

There are many home furnishing shops in Denmark, yet not all have physical stores nor are they well known. To find the best prices ind quality, check out some of these shops -

Useful Danish Phrases

Oct 07, 21 07:28 AM

Learning a few useful danish phrases or words can go a long way to making your stay or visit in Denmark more enjoyable. -

Aarhus Attractions

Oct 07, 21 07:08 AM

The number of Aarhus attractions may not be as big as Copenhagen, but there is still alot to see and do in this Danish city.